Origin-Based Sales Tax

Is your business located in an origin-based state or destination-based state for charging sales tax?

We are not tax professionals, for any questions regarding taxes or tax rates, our answers cannot be construed as legal advice. Always consult a tax professional for how to properly collect sales tax for your business.

| Overview | Configure Origin-Based Sales Tax |

| Origin-Based States | Additional Resources |

| Destination-Based States |

Overview

- Charging the correct sales tax can be tricky. The starting point is determining if your business is located in a state that charges origin-based or destination-based tax.

- For businesses located in an origin-based sales tax state, you should be charging everyone in your state the sales tax rate where your business is located.

- For businesses located in a destination-based tax state, the sales tax rate is based on where the item will be delivered.

Origin-Based States

| Arizona | California* | Illinois | Mississippi |

| Ohio | Pennsylvania | Tennessee | Texas |

| Utah | Virginia | Missouri |

* California is unique. It’s a modified origin state where state, county, and city taxes are based on the origin, but district taxes are based on the destination (the buyer).

Destination-Based States

| Alabama | Arkansas | Colorado | District of Columbia |

| Florida | Georgia | Hawaii | Idaho |

| Indiana | Iowa | Kansas | Kentucky |

| Louisiana | Maine | Michigan | Minnesota |

| Nebraska | Nevada | New Jersey | New Mexico |

| New York | North Carolina | North Dakota | Oklahoma |

| Rhode Island | South Carolina | South Dakota | Vermont |

| Washington | Wisconsin | Wyoming |

Configure Origin-Based Sale Tax

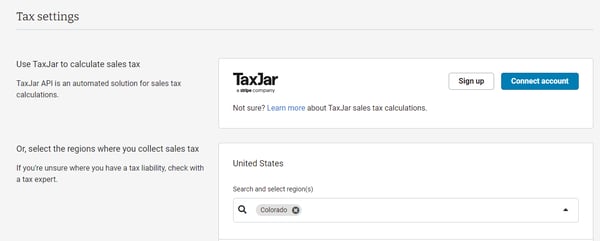

- In Admin, navigate to Settings > Commerce > Sales Tax.

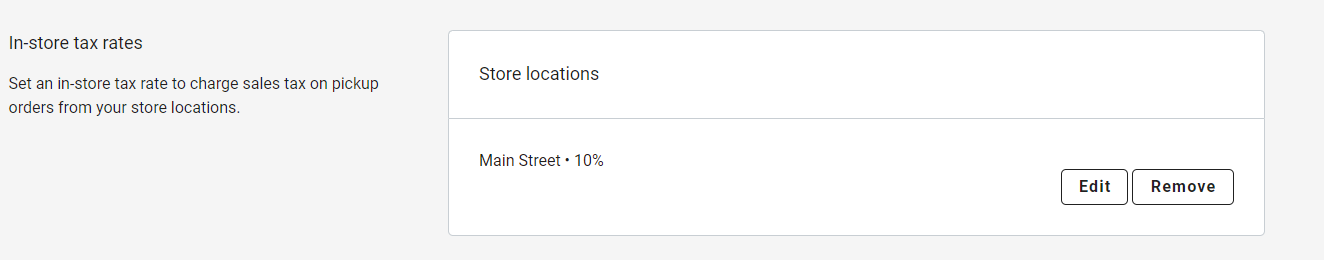

- Enter (or confirm) your store locations with the appropriate sales tax for the store location.

- Select only the state (or province) in which your stop is located.

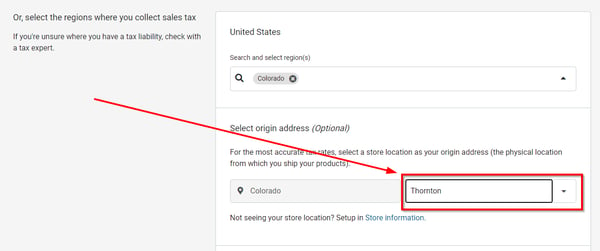

- In the Select origin address box, select the store location from the drop-down that you would like used as the origin address.

Please note that an origin address MUST be selected to enable origin-based sales tax collection. If an origin address is not selected then tax will only be charged for orders shipped to your home state.

Additional Resources

- Origin-Based and Destination-Based Sales Tax Rate (taxjar.com)

- Sales Tax by State: Economic Nexus Laws (taxjar.com)