Sales Tax

Learn how to set up and manage sales tax collection for your online business.

We are not tax professionals, for any questions regarding taxes or tax rates, our answers cannot be construed as legal advice. Always consult a tax professional for how to properly collect sales tax for your business.

Overview

- Our sales tax integration partners with TaxJar to calculate the appropriate tax on shipped and Home delivery orders.

- We do not remit sales tax, we allow you to collect it.

- Taxjar validates the address and then (allowing for nexus requirements) calculates the appropriate roof-top rate for the customer.

- In-store pickup orders use a flat rate structure that can be configured for each store.

You will need to configure sales tax for all delivery regions you have nexus in as well as each of your store locations.

Configuration

- Tax settings can be configured either directly in your TaxJar account or in Admin.

Admin Setup

- In Admin, navigate to Settings > Commerce > Sales Tax.

- Under Countries, add the states or regions you have nexus in (if you've configured sales tax settings previously, those settings will be pre-populated).

- Under In-store tax rates, enter the appropriate sales tax rate for each of your locations. If a rate is empty, no tax will be collected for in-store pickup orders at that location.

- Don't forget to maintain this list by adding rates for any new locations and adjusting rates as needed.

TaxJar API Setup

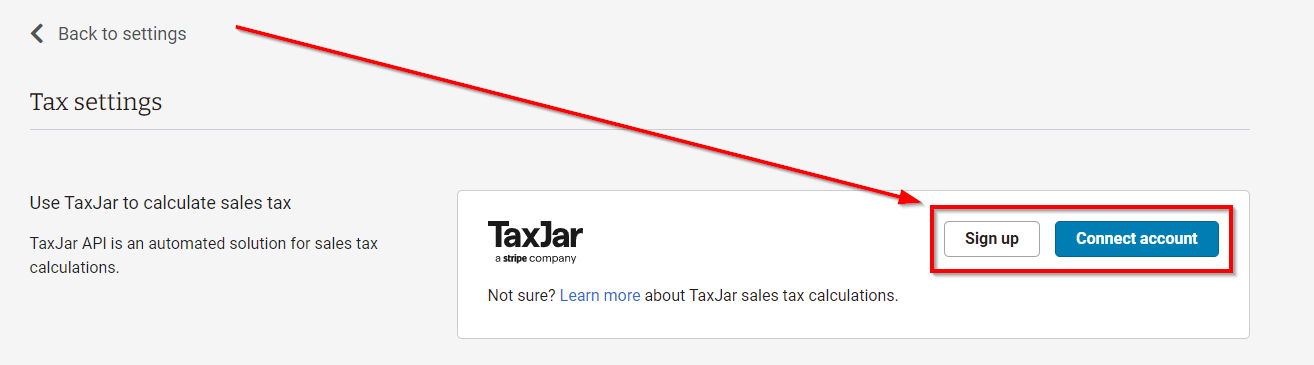

- To connect your TaxJar account, navigate in Admin to Settings > Commerce > Sales Tax.

- If you don't yet have a TaxJar account, click "Sign Up" to get started, otherwise click "Connect Account".

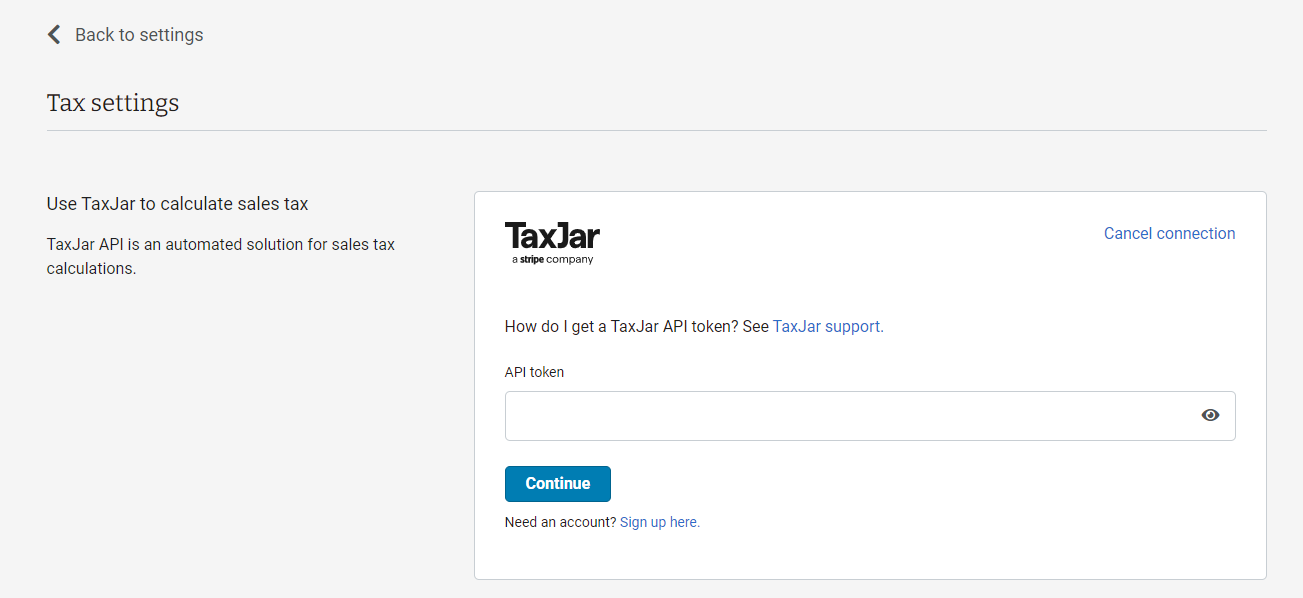

- Next, enter your API token and click "Continue".

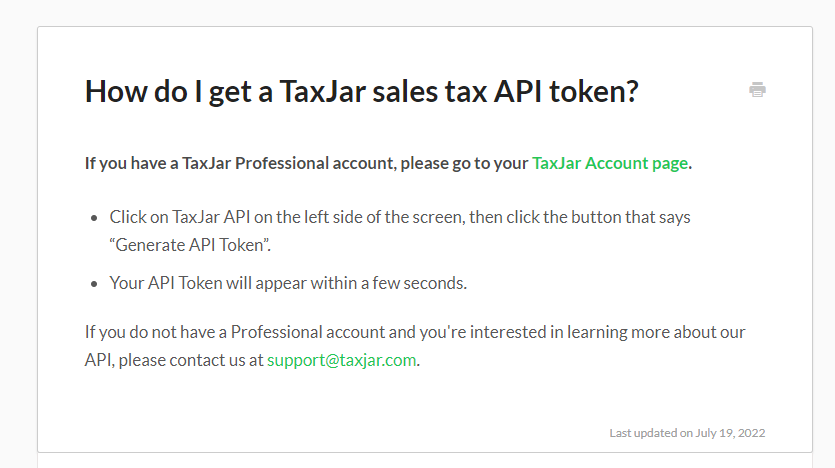

- Follow these instructions to generate your API token within your TaxJar account.

- We suggest creating two payment types in your POS system for recording your online orders when using a connected Taxjar account. This will provide your accountant with a way to confirm that you are not overpaying or underpaying tax collected.

- 'Ecommerce-shipped' - These orders will have tax calculated and remitted through your Taxjar account.

- "E-commerce-pickup" - These orders will be calculated based on your location's sales tax rate and will not be run through your Taxjar account.

- You can also download an Online Sales summary to review orders that are shipped versus picked up in-store. Navigate to Sales > Website Orders to find this.

- Taxjar Support is available through email (support@taxjar.com) or online chat on most screens in their help center.

Sales Tax Display

- In Admin when viewing Order Details, you can now view sales tax broken out by tax jurisdiction for each order.

- Click sales tax to view the details in a pop-up.

Tips

- Settings and configurations for your business vary by country. These guides may be helpful:

- For US businesses - Guide to Nexus Laws by State

- For Canadian businesses - Tax rates by province